App Development

Build powerful apps, faster than ever

Easily create apps that connect systems, pull data, and streamline workflows, using simple drag-and-drop tools. You can create a single, beautiful user interface that cuts through the noise and makes it easy to know what to do next. With purpose-built applications, teams can have the exact information, from any system, to move forward.

Nintex Apps

Build apps that work your way

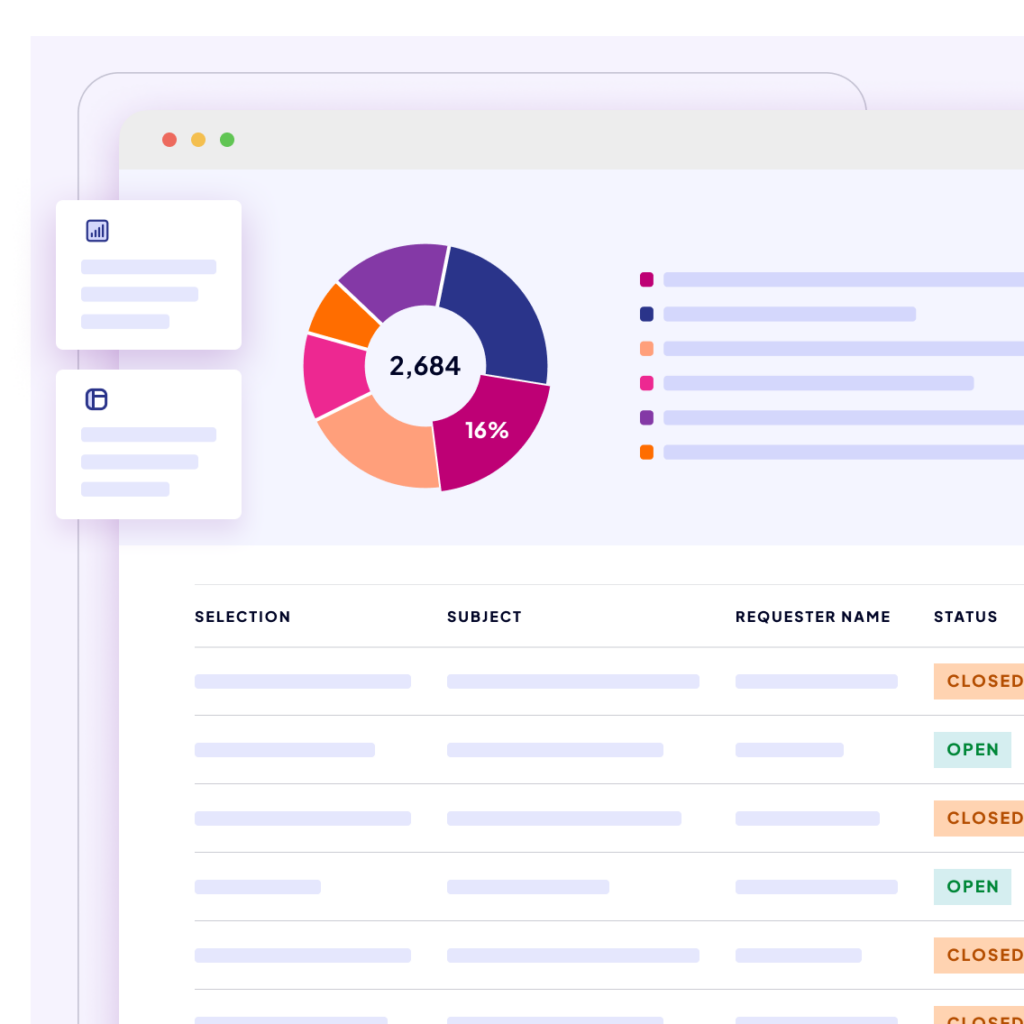

Our powerful UX gives your team the ability to directly interact with data for unmatched discovery and visibility into their work.

Intuitive design

Create apps your customers and employees will actually love using to track progress and interact with the information they need. Simply drag components into place, connect your data, and build each page, no coding required.

Flexible data integration

Combine data into a single view from sources like SQL, REST, and OData. Mix and match data to give users everything they need, right where they need it, so they can easily track and act on project details.

Easy customization

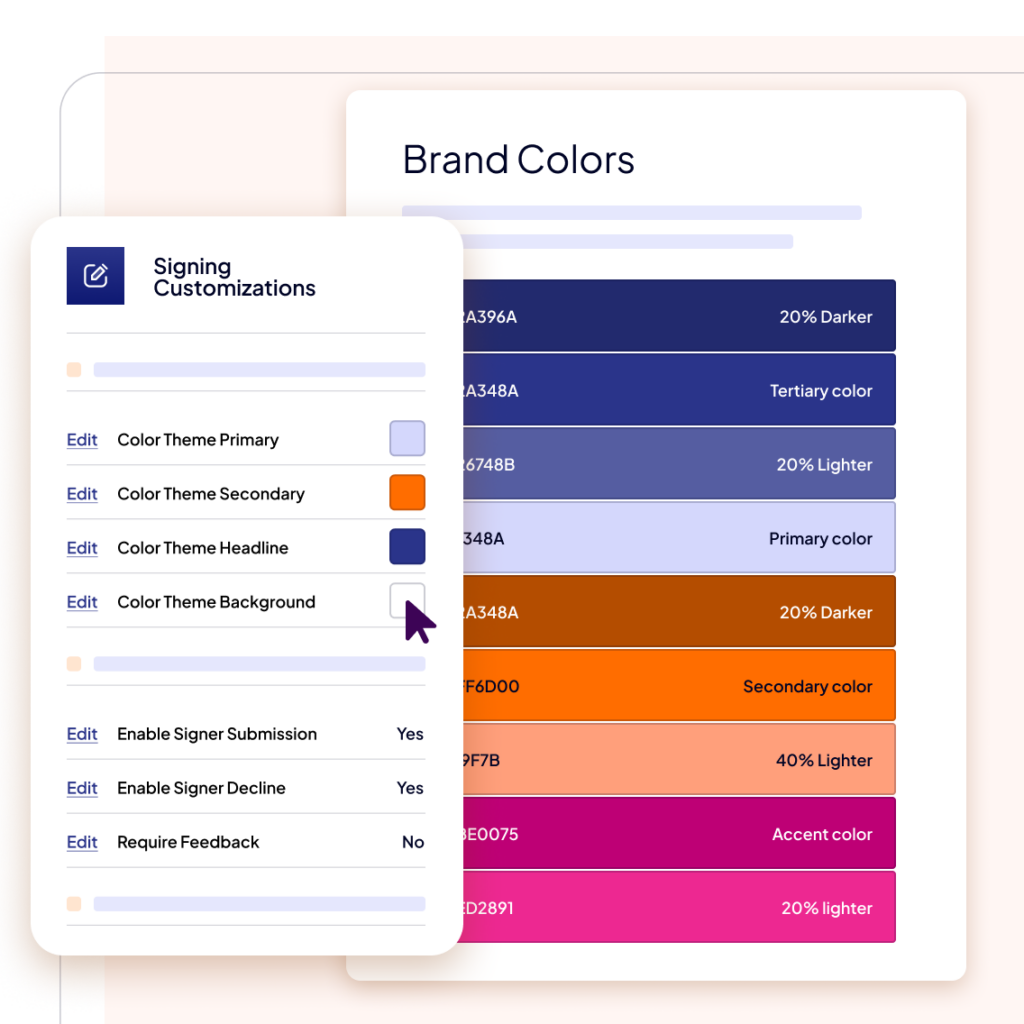

Create a look that matches your brand and make it easy for your team to connect with the data in a familiar setting. Use built-in styling tools to choose colors, fonts, and layouts – no HTML or CSS required.

Take a look

Create custom applications, no code required

Create apps by adding pages, connecting data, and then dragging-and-dropping components onto the page canvas. And with everything built to be responsive, you don’t have to worry about manually adding breakpoints or designing multiple variations.

How Nintex makes work better

Connect data

Connect multiple data sources

Bring all your data and workflows together into one seamless experience. Nintex Apps connects to the Nintex Automation platform, providing the apps with powerful workflow capabilities that enable you to integrate multiple out-of-the-box data sources and orchestrate processes across systems.

UI flexibility

Customize your page layout

Choose from more than 25 drag-and-drop components to customize your page. Organize data, add visuals, and display key details the way you want – without any coding.

Apply logic

Create logic flows that act on your data

Build actions and expressions that respond to your data in real time when certain conditions are met. Change styles, trigger actions, and create dynamic experiences based on how users interact.

Scalable design systems

Design apps that fit your brand

Keep your app on-brand with customizable colors, fonts, buttons, and more. Easily match your app to your company’s design system or style guide – no need for CSS or HTML skills.

Explore ways to use app development

Streamline Microsoft Teams governance processes

Nintex Workflow Cloud provides a solution to Microsoft Teams governance that enables a truly modern collaboration experience.

Automate order-to-cash processes with the Nintex Platform

Use the Nintex platform to streamline the order-to-cash process by using features like eSignature, process mapping, and advanced workflow.

Accelerate accounts receivable collections with Nintex

Managing accounts receivable followups is one of the most important tasks a company has. Learn how Nintex Workflow and Intelligent Process Automation can help and schedule your demo today.

Featured demo

See app dev success firsthand with a Nintex demo

We’re happy to demonstrate one of the amazing experiences that have been built with Nintex Apps.

Accelerate your app development onboarding

Jump-start your Nintex application development with expert training, mentorship, and guidance from Nintex Professional Services.

See for yourself

Put Nintex to the test

Because seeing is believing, let us give you a firsthand look at how Nintex can work for you.